Na to, že můžeme cestovat pomalu kamkoliv, kam si jenom usmyslíme, jsme si už zvykli. A nikoho už dnes moc neudivíme ani tím, že se …

Jistota je jistota

Jsou země, které se vyznačují vysokou ekonomickou úrovní, a jsou i ty, jež jsou v tomto ohledu pozadu. A situace zemí ovlivňuje i život jejich obyvatel.

Na to, že můžeme cestovat pomalu kamkoliv, kam si jenom usmyslíme, jsme si už zvykli. A nikoho už dnes moc neudivíme ani tím, že se …

Kanada je opravdu zajímavou zemí, která zdaleka neláká jen dobrodruhy, ale dokáže nabídnou každému právě to, co jeho srdce žádá. Pokud se opravdu stane vaší …

Název humanitární a rozvojové organizace Adra, jistě není nikomu neznámý. Adra pomáhá v nouzi lidem v České republice i v zahraničí. Jejím hlavním cílem je …

Jeden nikdy neví, co se mu může všechno přihodit. A neví to nejen v dlouhodobém časovém horizontu, ale často ani o nejbližších okamžicích, jež nastanou. …

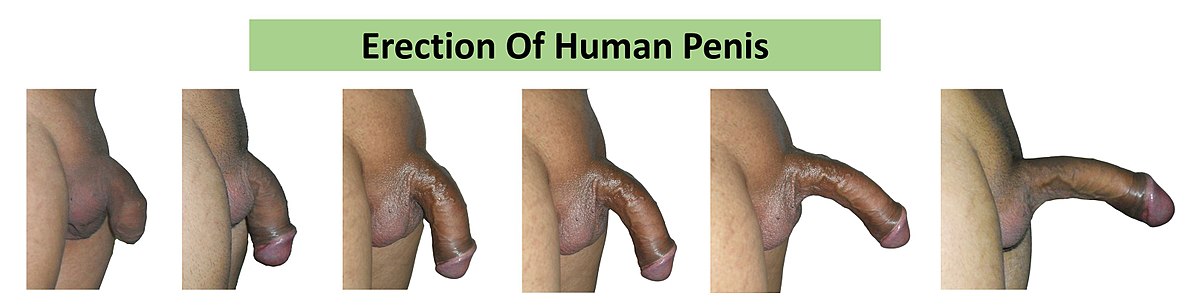

Vztahy by neměly být založené na sexu, ale sex by v každém vztahu měl fungovat. Nemá jen funkci uspokojit své tělesné potřeby, ale prohlubuje intimitu …

Sex se pro muže může proměnit v noční můru, pokud ho začnou trápit poruchy erekce. Často se v obavě ze selhání milostným hrátkám raději vyhýbá. …

Mnoho druhů této potraviny obsahuje pÅ™ÃliÅ¡ mnoho cukru a tuku. PÅ™edem namÃchané müsli ze supermarketu nebo prodejny zdravých potravin Äasto nejsou dobrým zaÄátkem dne, ale …

ÄŒeÅ¡i jsou národem kutilů, to je sice pravda, ovÅ¡em nenà to důvod k tomu, takovými lidmi pohrdat. MÄ›li bychom si na nich naopak cenit jejich nápaditosti. …

SenioÅ™i se ani v pozdnÃm vÄ›ku nemusà vzdávat svých zálib a konÃÄků. Spousta seniorů ráda cestuje. Nemusà se, ale vydat hned na nÄ›kolika týdennà pobyt …

ZastÅ™eÅ¡ené stadiony Léto je vhodnou dobou pro to využÃt nabÃdku zimnÃch stadionů skrytých pod stÅ™echou, které Vám poskytnou nejen mÃsto k pohybové aktivitÄ› a netradiÄnÃmu letnÃmu …